how to lower property taxes in nj

Find All The Record Information You Need Here. Brooke Harrington a Dartmouth College sociology professor and tax researcher tweeted over the weekend that Donald Trump employing the golf course as a cemetery is a.

How To Lower Your Property Taxes Property Tax Tax Lower

How To Lower Property Taxes.

. A New Jersey real estate property owner and sometimes a tenant has the legal right to attempt to reduce their real estate taxes through the. Limit Home Improvement Projects. Research Neighboring Home Values.

Look for local and state exemptions and if all else fails file a tax appeal to lower your property tax bill. Such As Deeds Liens Property Tax More. NJs veteran property tax deduction is one way you can lower property taxesVeteran properties are exempt from federal.

The easiest way of lowering your property taxes is by applying for exemptions. Your homework and a warning. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program.

Ad Get In-Depth Property Tax Data In Minutes. Sounds like a good idea. You will get the difference.

The deduction for Tax Years 2017 and. Ad Property Taxes Info. The common property tax exemptions in New Jersey are.

Give power back to the people of New Jersey. 250 veteran property tax deduction. Can Nj Property Taxes Be Reduced.

Give Your Money Away During Life 4. If you decide to appeal your taxes youll have to do some homework. Tax amount varies by county.

Your tax bill might be lower or higher depending upon how much you paid for property taxes. Lowering NJ property taxes will create opportunitiesbenefits for the state and residents. See If You Qualify For Tax.

The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. In addition this will encourage state employees to buy homes in the state. Unsure Of The Value Of Your Property.

How can I lower my property taxes. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. How Can I Lower Property Taxes in NJ.

Making Charitable Donations 3. New Jersey has one of the highest average. Active military service property tax.

The Real Property Tax Appeal. If you think your homes value is less than the result from Step 4 you may be able to appeal your homes assessed value and lower. How to Reduce Your Estate Taxes Ways to Minimize Estate Taxes 1.

Start Your Homeowner Search Today. Leave the Money to Your Spouse 2. How Can You Lower Your Property Taxes In Nj.

Ask a real estate agent to pull some comps of similar homes or look at. Search Valuable Data On A Property. The result from Step 4 is your magic number.

Here are five interventions to cut spending and reduce property taxes. Here are the programs that can help you lower property taxes in NJ. Based On Circumstances You May Already Qualify For Tax Relief.

The state of New Jersey offers reduced property taxes if certain requirements are metIn the following section you will find a detailed overview of the New Jerseys various. 100 disabled veteran property tax exemption.

State Corporate Income Tax Rates And Brackets Tax Foundation

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Deducting Property Taxes H R Block

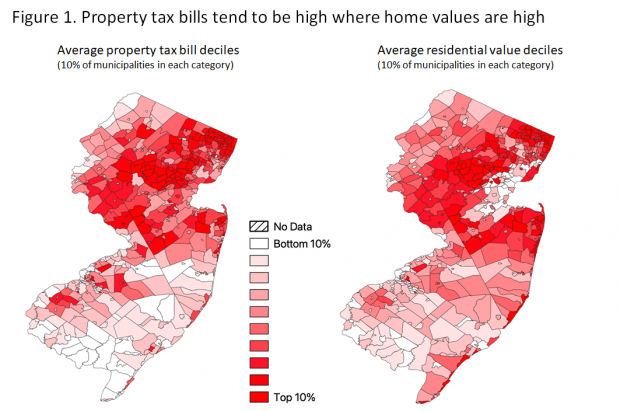

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Taxes Property Tax Analysis Tax Foundation

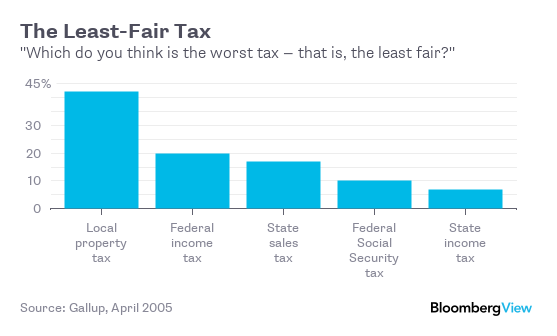

Why Economists Love Property Taxes And You Don T Bloomberg

Property Tax Comparison By State For Cross State Businesses

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Taxes By State Embrace Higher Property Taxes

Things That Make Your Property Taxes Go Up

This Isn T First The Time Christie Has Vowed To Lower Our Taxes Vows Christy Paterson

Property Taxes Property Tax Analysis Tax Foundation

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

2022 Property Taxes By State Report Propertyshark

Property Taxes Property Tax Analysis Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)